Dear Dave,

I’m 29, and I have no debt. I’ve gotten a good start on my savings and retirement, too. My girlfriend and I plan to get married in the next couple of years, and she has about $90,000 in debt. I’m not paying on her debt yet, but I think together we can save up enough to pay it off by the time we’re married. Should I temporarily slow down saving for a house and start saving toward paying off her debt?

James

Dear James,

Yes, I would have a “girlfriend debt” account. That way when she becomes your wife, you two can write a check the moment you get back from the honeymoon and be debt-free — or at least knock out a huge portion of the debt. After that, the two of you — as in WE — resume saving for retirement, a house and so on.

That, James, is exactly what I would do. You’re right in line with my thinking on this, brother. Best of luck to you both!

—Dave

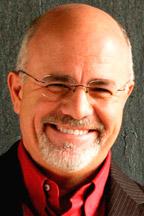

Dave Ramsey has five New York Times best-selling books. “The Dave Ramsey Show” is heard by more than 8.5 million listeners each week on more than 550 radio stations. Ramsey’s latest project, EveryDollar, is a free online budget tool.

Please read our Comments Policy before posting.

Article comments powered by Disqus Studio 3:16 offers new approach to teaching religion

Studio 3:16 offers new approach to teaching religion

After three decades, NLR principal plans to retire

After three decades, NLR principal plans to retire

CHS athlete overcomes odds to reach collegiate goal

CHS athlete overcomes odds to reach collegiate goal

John Calipari: UA basketball coach and devout Catholic

John Calipari: UA basketball coach and devout Catholic

'Cabrini' film tells story of saint with great faith

'Cabrini' film tells story of saint with great faith