Dear Dave,

I make $80,000 a year, and I was wondering if there’s an easy way to determine how much money a person would need to live comfortably after retirement.

John

Dear John,

A commonsense rule of thumb, if you’ve got your money invested in good growth stock mutual funds, is to pull from those funds at a rate that is lower than which they are growing. Otherwise, you’ll destroy them, right?

I tell folks if they want to pull off 6 percent to 8 percent — I’m comfortable doing 8 percent — then you’ve got to decide exactly how much you want to live on and what that means for your nest egg. If you want to live on $80,000 a year, it means you have to have a $1 million nest egg. If you want to live on $40,000 a year, then you need a half-million dollar nest egg for what we’re talking about here.

To get into that a little bit further, I would advise going to Chris Hogan’s website. He’s got a tool on there that takes just a few minutes, and it will give you exact numbers on what you need to do. It’s ChrisHogan360.com, and the tool is called the R:IQ — your Retire Inspired Quotient.

You can walk through it, and in just a few minutes you’ll know exactly what’s going on and what needs to happen.

—Dave

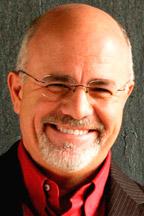

Dave Ramsey has five New York Times best-selling books. “The Dave Ramsey Show” is heard by more than 8.5 million listeners each week on more than 550 radio stations. Ramsey’s latest project, EveryDollar, is a free online budget tool.

Please read our Comments Policy before posting.

Article comments powered by Disqus Don’t let misconceptions cause faith to waver

Don’t let misconceptions cause faith to waver

Seniors, whatever storms may come, Jesus will be there

Seniors, whatever storms may come, Jesus will be there

Studio 3:16 offers new approach to teaching religion

Studio 3:16 offers new approach to teaching religion

After three decades, NLR principal plans to retire

After three decades, NLR principal plans to retire

CHS athlete overcomes odds to reach collegiate goal

CHS athlete overcomes odds to reach collegiate goal